CORPORATE ACTION

The Circularity Myth

.png&width=710&height=550)

Circularity is the new thing in plastics – 'circles', 'loops', 'closed systems'… - anything that moves away from single-use. It’s a laudable goal and companies of all stripes are touting their efforts.

But break down the pledges and the numbers and much of it looks inadequate.

Porous commitments

In the CPG space, the most widely accepted plastic abatement targets come from the Ellen MacArthur Foundation New Plastics Economy Global Commitment, which calls for all plastic packaging to be “easily and safely reused, recycled, or composted by 2025.”

But these three options are not at all equal. Creating at industrial scale plastics that are food safe, robust, economic, meet supplier standards and are compostable is a substantial challenge. Instead, focus will be on the ‘recyclable’ option. This simply means the plastic could be recycled. If plastics users can point to processes and technologies that enable current packaging to be recycled, this condition is met even if it isn’t recycled.

Recycling capacity is already lacking and as more post-consumer use recyclable plastic arrives, it’s clear much or most will end in landfill or the oceans.

Signatories to the New Plastics Economy also have targets for the percentage of recycled plastic in all plastic packaging by 2025, but this number isn’t high. It’s typically 25% but the range amongst companies is wide.

For the 19 large (above US$10 billion in annual revenues) packaged goods companies profiled in the "NEW PLASTICS ECONOMY GLOBAL COMMITMENT SPRING 2019 REPORT”, March 2019, six have set a 25% recycled plastic target for 2025, one (Diageo) a 40% target, and two (SC Johnson and Nestlé) a 15% target. Seven have yet to set a target, and Coca-Cola has set a 50% target, but for 2030.

According to our calculations, these moderate targets largely ensure demand for virgin plastic will continue to rise.

Demand for virgin PET likely to increase

Even allowing for the efforts to reduce the amount of PET used in each container, forecasts suggest that global PET demand is set to grow around 4%-5% pa.

Assuming growth at the lowest end of that range and that the global industry manages to 30% recycled PET by 2030, demand for virgin PET will still be around 20% higher in 2030 than today.

At these growth rates, demand for virgin plastic only starts to fall around 50% recycled PET.

Looked at another way, from 2019 to 2030, we’re set for over 400 million tonnes of PET that will not be recycled and that will end up in landfill, incinerators or the oceans.

Even with the New Plastic Economy commitments, we remain far from a circular economy.

Limitations of the ‘circular’ economy commitments

In our view, terms used in the plastic debate are too imprecise. Specifically, we’re missing a word to describe recycling to a comparable use, so recycling a food-use PET bottle to another food-use PET bottle. Too often ‘recycling’ means a lower grade use and PET bottles are reborn as benches, other plastic furniture or plastic bricks.

Double-use plastic is better than single-use, but it’s in no way circular and this downcycling doesn’t deserve to be called ‘recycling’. What we need is closed-loop recycling and the moves so far are very distant from delivering this.[Image Credit: © Business360]

Recent Legislative Moves In The U.S. Underscore Challenges Plastic Users Face

Developments in three states show how legistatlors are moving to limit plastic use.

In Hawaii, the state Senate recently passed two bills. Senate Bill 2285 banned straws “comprised in full or part of plastic”, while a more far reaching bill, Senate Bill 522, would prohibit the use of “single-use plastic beverage bottles, utensils, stirring sticks, polystyrene foam containers, or straws after July 1, 2021”, and by businesses selling food and beverages by the following year. It also bans the distribution or sale of “any form of plastic bag after July 1, 2023” and “any form of single-use plastic beverage containers after July 1, 2025.” The bills have yet to get through House committees and the full House before heading to the governor.

In California, AB-1080 California Circular Economy and Plastic Pollution Reduction Act released February 21, 2019 and amended in Assemby May 7, 2019, aims to greatly limit all single-use plastic packaging or products. The proposed legislation seeks to do this by requiring manufacturers of single-use plastic packaging or products sold or distributed in California to attain ever higher recycling rates. Specifically, manufacturers would need to “demonstrate a recycling rate of not less than 20% on and after January 1, 2022, not less than 40% on and after January 1, 2026, and not less than 75% on and after January 1, 2030”.

This legislation would build on previous plastic-use restrictions. The state was the first to prohibit single-use plastic bags (2014) and last year became the first state to limit use of plastic straws in restaurants.

In New York, State lawmakers imposed a statewide ban on most types of single-use plastic bags from retail sales. Individual counties and cities within the state will have the chance to opt into a 5 cent fee on paper bags. The plastic bag ban will eliminate an estimated 12 million barrels of oil used to make plastic bags used by New York each year.

Previious research estimated that New York uses 23 billion plastic bags each year with 50% of those ending up in landfills and around the city and waterways.

In Hawaii, the state Senate recently passed two bills. Senate Bill 2285 banned straws “comprised in full or part of plastic”, while a more far reaching bill, Senate Bill 522, would prohibit the use of “single-use plastic beverage bottles, utensils, stirring sticks, polystyrene foam containers, or straws after July 1, 2021”, and by businesses selling food and beverages by the following year. It also bans the distribution or sale of “any form of plastic bag after July 1, 2023” and “any form of single-use plastic beverage containers after July 1, 2025.” The bills have yet to get through House committees and the full House before heading to the governor.

In California, AB-1080 California Circular Economy and Plastic Pollution Reduction Act released February 21, 2019 and amended in Assemby May 7, 2019, aims to greatly limit all single-use plastic packaging or products. The proposed legislation seeks to do this by requiring manufacturers of single-use plastic packaging or products sold or distributed in California to attain ever higher recycling rates. Specifically, manufacturers would need to “demonstrate a recycling rate of not less than 20% on and after January 1, 2022, not less than 40% on and after January 1, 2026, and not less than 75% on and after January 1, 2030”.

This legislation would build on previous plastic-use restrictions. The state was the first to prohibit single-use plastic bags (2014) and last year became the first state to limit use of plastic straws in restaurants.

In New York, State lawmakers imposed a statewide ban on most types of single-use plastic bags from retail sales. Individual counties and cities within the state will have the chance to opt into a 5 cent fee on paper bags. The plastic bag ban will eliminate an estimated 12 million barrels of oil used to make plastic bags used by New York each year.

Previious research estimated that New York uses 23 billion plastic bags each year with 50% of those ending up in landfills and around the city and waterways.

CAMPAIGNS, COMMITMENTS & NGOs

Pressure On Plastic Using Brands And Companies Continues To Rise: Spotlight On Break Free From Plastic

Corporations that use plastic risk bad press from a range of sources and one that has growing influence is #breakfreefromplastic. Since September 2016, the organization has worked to reduce or end plastic use on a number of fronts.

Corporations that use plastic risk bad press from a range of sources and one that has growing influence is #breakfreefromplastic. Since September 2016, the organization has worked to reduce or end plastic use on a number of fronts.Its Brand Audit, which it claims is the most comprehensive snapshot of the worst plastic polluting companies around the world, is proving an effective way to target and shame corporations. By using volunteers working around the world, Break Free has compiled a database of polluting brands and companies. Its data covers 42 countries and over 187,000 pieces of plastic trash that Break Free examines to identify the source brand.

In October 2018 it released its first report.

It continues to get press and, for example, in February 2019, The Street summarized output from the report and again emphasized how the top four polluters are all drinks manufacturers: Coca-Cola, PepsiCo, Nestle and Danone.

Break Free identified Coca-Cola as the top global polluter, with Coke-branded plastic pollution found in 40 of the 42 participating countries.

In North and South America, Coca-Cola, PepsiCo, and Nestlé brands were the top polluters identified, accounting for 64 and 70 percent of all the branded plastic pollution, respectively.

Coca-Cola, PepsiCo, Nestlé, Danone, Mondelez International, Procter & Gamble, Unilever, Perfetti van Melle, Mars Incorporated, and Colgate-Palmolive were the most frequent multinational brands collected in cleanups.

The data underlying the report is available online, where it can be filtered and sorted. [Image Credit: © Justin Hofman, Greenpeace]

CONSUMER & PUBLIC OPINION

Survey Of German Consumers Shows High Level Of Plastics Concern And Challenge Of Changing Behavior

A survey by the German Packaging Institute (dvi) finds that consumers are concerned about plastic waste yet unlikely to change behaviors to limit waste. 45% of survey respondents say they feel personally responsible for ocean public waste, a higher proportion than consider product manufacturers and retailers responsible (36%).

Support is lukewarm for alternative packaging (38%), stricter rules or bans on environmentally materials (31%) or companies that use reusable or deposit packaging (25%).

The survey also makes clear consumer resistance to change. Just 19% believe they’d find it easy to consume in a more sustainable way but 37% say they’d be prepared to make changes in food consumption to be more environmentally conscious and live more sustainably.

Support is lukewarm for alternative packaging (38%), stricter rules or bans on environmentally materials (31%) or companies that use reusable or deposit packaging (25%).

The survey also makes clear consumer resistance to change. Just 19% believe they’d find it easy to consume in a more sustainable way but 37% say they’d be prepared to make changes in food consumption to be more environmentally conscious and live more sustainably.

PACKAGING REDESIGNS

Poland Spring 100% rPET Bottled Water Goes Nationwide Beginning In May

Nestlé Waters NA brand Poland Spring is making its bottled spring water available nationwide for the first time. Poland Spring ORIGIN will be packaged in “ergonomic” 100 percent food-grade recycled plastic (rPET) bottles. According to Nestlé Waters, ORIGIN's 100 percent natural spring water has been sustainably sourced from the White Cedar Spring in Maine, filtered by 10,000-year-old glacial sands. It contains no additives other than the minerals that come from the earth, including naturally occurring electrolytes. The product will be nationally available on Amazon.com in a 12-pack of 900 ml bottles, and via delivery by ReadyRefresh Nestlé. From May 2019, Poland Spring ORIGIN will be available in select retail locations in Florida and Texas with plans for national retail expansion in 2020. Meanwhile, litigation over the sources of Poland Spring water continues to churn in courts in Maine, Connecticut, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, and Rhode Island.[Image Credit: © Nestlé Waters North America]

Nestlé Waters NA brand Poland Spring is making its bottled spring water available nationwide for the first time. Poland Spring ORIGIN will be packaged in “ergonomic” 100 percent food-grade recycled plastic (rPET) bottles. According to Nestlé Waters, ORIGIN's 100 percent natural spring water has been sustainably sourced from the White Cedar Spring in Maine, filtered by 10,000-year-old glacial sands. It contains no additives other than the minerals that come from the earth, including naturally occurring electrolytes. The product will be nationally available on Amazon.com in a 12-pack of 900 ml bottles, and via delivery by ReadyRefresh Nestlé. From May 2019, Poland Spring ORIGIN will be available in select retail locations in Florida and Texas with plans for national retail expansion in 2020. Meanwhile, litigation over the sources of Poland Spring water continues to churn in courts in Maine, Connecticut, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, and Rhode Island.[Image Credit: © Nestlé Waters North America]

POLICY, REGULATION & LEGAL

Maine Becomes First State To Ban Foam Food Packaging

Legislation sighed by Maine Governor Janet Mills will ban foam food containers from Jan 1, 2021. The ban covers cups, plates, bowls, trays, cartons, and other containers designed to hold prepared food and beverages. Maine joins a number of cities where foam food containers have already been banned, including New York, San Diego, San Francisco, Seattle, Miami Beach and Portland.

Legislation sighed by Maine Governor Janet Mills will ban foam food containers from Jan 1, 2021. The ban covers cups, plates, bowls, trays, cartons, and other containers designed to hold prepared food and beverages. Maine joins a number of cities where foam food containers have already been banned, including New York, San Diego, San Francisco, Seattle, Miami Beach and Portland.The American Chemistry Council objected to the legislation, arguing that alternative food packaging can be nearly double the cost, adding that the ban will do little to keep the state clean and may cause greater use of energy and water and increase greenhouse gas emissions.[Image Credit: © Wiki Commons]

European Parliament Votes To Ban Range Of Single-Use Plastics

the aim of reducing plastic littering and ocean pollution, the European parliament voted to end single-use plastic for a range of purposes by 2021. In addition to covering cutlery, cotton buds, straws and stirrers, the legislation would ban single-use polystyrene cups as well as those made from oxo-degradable plastics.

the aim of reducing plastic littering and ocean pollution, the European parliament voted to end single-use plastic for a range of purposes by 2021. In addition to covering cutlery, cotton buds, straws and stirrers, the legislation would ban single-use polystyrene cups as well as those made from oxo-degradable plastics.For plastic bottles, legislation requires that rPET content should be 25% by 2025 and 30% by 2030. It also requires that 90% of bottles should be collected by 2029. Wood Mackenzie Chemicals is skeptical the collection target will be reached.

It points out that in 2017 the European PET beverage bottle collection rate was 58% and that moving to 90% would require over 60 new reprocessing plants.

Beyond PET, Europeans generate 25m tonnes of plastic waste each year, with less than 30% collected for recycling.[Image Credit: © EU Parliament]

INNOVATION & TECHNOLOGY

Nestlé Waters, PepsiCo And Suntory Join Consortium To Leverage Enzymatic PET-Recycling Technology

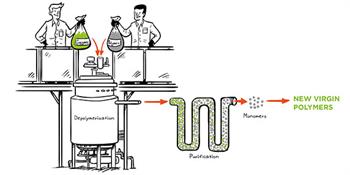

Nestlé Waters, PepsiCo and Suntory Beverage & Food Europe joined a Consortium founded by Carbios and L’Oréal to industrialize Carbios’ technology that breaks down PET plastic waste into its original components, allowing it to be reused much like virgin PET.

Nestlé Waters, PepsiCo and Suntory Beverage & Food Europe joined a Consortium founded by Carbios and L’Oréal to industrialize Carbios’ technology that breaks down PET plastic waste into its original components, allowing it to be reused much like virgin PET.Carbios claim its technology can allow for 100% recycled PET content in new products and offers the potential to recycle PET plastics repeatedly.

The new partners joined a four-year agreement that aims to bring Carbios’ PET-enhanced recycling technology to market and increase the availability of high-quality recycled plastics to fulfill their sustainability commitments. The collaboration includes technical milestones and support for the efficient supply of consumer-grade, 100% recycled PET plastics for global markets.

Carbios was founded in 2011 and has developed two industrial-scale biological processes for the biological breakdown and recycling of polymers. It plans to commercialize its technology then roll it out through direct license agreements or joint ventures.[Image Credit: © Nestlé Waters]

PureCycle Technologies Partners With Nestlé And Milliken, To Advance Polypropylene (PP) Recycling

The plant is scheduled to start in 2021 and will take in 119 million pounds of polypropylene and produce about 105 million pounds of usable resin.

PureCycle sees tremendous opportunity. Currently just 1% of polypropylene is recycled and the global polypropylene market is estimated to be over $80 billion today and set to exceed $133 billion by 2023. Demand for recycled polypropylene should rise strongly as product suppliers move to meet sustainability goals. For North America, The Association of Plastics Recyclers estimates that there is already demand for some 1 billion pounds of recycled polypropylene. [Image Credit: © PureCycle Technologies]

Copyright 2026 Business360, Inc.