CORPORATE ACTION

CPGs Release Progress On Plastics Abatement. Summary Analysis

We conducted some summary analysis on a subset of the 30 large packaged goods companies (over US$1 billion in annual revenues), looking at personal care, beauty, food and beverage (including alcoholic beverages) companies, most of which are Business360 clients.

Access our summary pdf here and contact us for further details.

Some highlights:

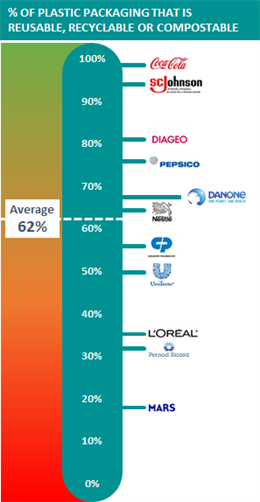

62% of their plastic packaging is already reusable, recyclable or compostable, against a 2025 target of 100%

Almost all plastic that qualifies under this goal is recyclable, rather than reusable or compostable. Across the signatories, on average by weight, about 60% of plastic is recyclable, less than 3% reusable, and less than 1% compostable.

Coca-Cola is the best performer with 99% of its primary plastic packaging determined to be reusable, recyclable or compostable, but it has a relatively easier task: it uses PET predominantly; others work with a much wider range of plastics.

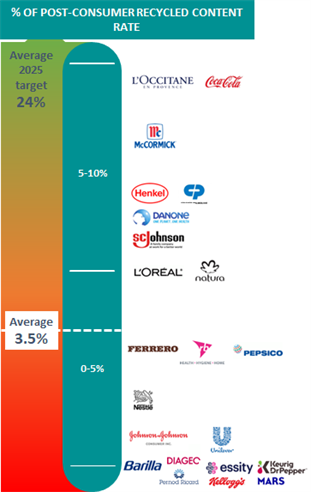

Companies are struggling to boost post-consumer recycled (PCR) content

Currently just 3.5% of packaging on average is PCR against a 2025 target of 24% (this is an average, some companies have less onerous goals).

A key factor is limited availability of high-quality recycled waste materials, driven by:

-

Inadequate recycling systems that don’t have the capacity to meet demand

-

Low oil prices that make virgin plastic inexpensive

-

Legislation on food contact that complicates use of recycled plastic

High demand means CPGs compete for available volumes of PCR

Forward thinking companies are looking at alternative ways to secure supply, including investing in and closer partnerships with recycling companies

'Plastic intensity' set to decline

'Plastic intensity' set to declineWhere possible, we calculated the ‘plastic intensity’ of each company, being the total metric tonnes of plastic per unit of revenue.

We expect this measure will be a closely-watched metric as CPGs ‘deplastize’.

Soft drink and water companies (Coca-Cola, PepsiCo, and Danone) use by far the most plastic per unit of revenue.

Coca-Cola standards apart, using way more than any other, nearly 3X the amount per unit of revenue than PepsiCo and about 10X the amount of some CPGs.

There are several non-beverage companies (e.g. Colgate, Henkel and Unilever) that use significantly more plastic per unit of revenue than others.

The performance of Pernod Ricard and L’Occitane show what’s possible through using non-plastic solutions (glass, metal and paper/cardboard).

CPG companies face a substantial challenge in lowering plastics use. An outpouring of consumer anger about plastic is forcing them to rethink many business practices. Change is required on numerous fronts and requires considerable investment. Some companies are advancing well but others look to be struggling with the scope of the challenge, yet these challenges are set to rise as looming regulations in numerous jurisdictions is requiring them to quickly adapt.

For more details or assistance in keeping up with all these change, contact us.

CORPORATE ACTION: Coca-Cola

Australia’s Coke Bottlers Now Use 100 Percent Recycled Plastic Packaging

Coca-Cola Australia and Coca-Cola Amatil announced that all Coca-Cola soft drink brands (600 ml and below) – including Coca-Cola, Sprite, and Fanta – and all water brands (600 ml and below) – including Mount Franklin and Pump – in Australia are now being produced in 100 percent recycled plastic bottles. Coca-Cola Amatil announced earlier this year that it will make seven out of 10 plastic bottles from 100 percent recycled plastic by the end of 2019. Coca-Cola’s juice and dairy brands are transitioning toward that goal before the end of the year. In addition, Coca-Cola Australia has ramped up its efforts to promote recycling to all Australians.[Image Credit: © Coca-Cola Amatil Limited]

Coca-Cola Australia and Coca-Cola Amatil announced that all Coca-Cola soft drink brands (600 ml and below) – including Coca-Cola, Sprite, and Fanta – and all water brands (600 ml and below) – including Mount Franklin and Pump – in Australia are now being produced in 100 percent recycled plastic bottles. Coca-Cola Amatil announced earlier this year that it will make seven out of 10 plastic bottles from 100 percent recycled plastic by the end of 2019. Coca-Cola’s juice and dairy brands are transitioning toward that goal before the end of the year. In addition, Coca-Cola Australia has ramped up its efforts to promote recycling to all Australians.[Image Credit: © Coca-Cola Amatil Limited]

CORPORATE ACTION: Nestlé

Nestlé Is Replacing Plastic Straws With Paper In Malaysia, Indonesia

Nestlé Malaysia and Indonesia have decided to switch from plastic straws to paper straws for use on UHT-packaged drinks. The company said the paper options are top quality as well as “effective” and “scalable.” The first product SKU in Malaysia that will implement the change as a pilot project is Nestlé Malaysia’s Milo UHT 125ml packs, set to debut in December. Consumer research on the straw prototypes found that the paper straw was sufficiently sturdy to serve its purpose “for the average duration required to consume the product.” Successful implementation of the packaging innovation is expected to cut down the use of plastic straws by some 40 million a year. Nestlé Indonesia is planning to roll out the new packaging for other ready-to-drink products in phases with the goal of eliminating 450 million plastic straws by full roll-out. Nestlé Malaysia will continue to concentrate on Milo UHT for the time being.[Image Credit: © Nestlé (Malaysia) Berhad]

Nestlé Malaysia and Indonesia have decided to switch from plastic straws to paper straws for use on UHT-packaged drinks. The company said the paper options are top quality as well as “effective” and “scalable.” The first product SKU in Malaysia that will implement the change as a pilot project is Nestlé Malaysia’s Milo UHT 125ml packs, set to debut in December. Consumer research on the straw prototypes found that the paper straw was sufficiently sturdy to serve its purpose “for the average duration required to consume the product.” Successful implementation of the packaging innovation is expected to cut down the use of plastic straws by some 40 million a year. Nestlé Indonesia is planning to roll out the new packaging for other ready-to-drink products in phases with the goal of eliminating 450 million plastic straws by full roll-out. Nestlé Malaysia will continue to concentrate on Milo UHT for the time being.[Image Credit: © Nestlé (Malaysia) Berhad]

CORPORATE ACTION: Other

The 2019 Recycling Tracker Is Wrap UK’s Largest Survey Yet

Ambev Shifts To Aluminum Packaging For Water Products

Brazil’s Ambev SA is expected to launch its first canned water by the end of 2019 in a nod to global trend of increased recyclability and reduction in the use of plastic containers. as consumers shift toward greener alternatives, a company executive said. Parent company Anheuser Busch InBev has begun adopting more sustainable practices. Other multinationals, such as Coca-Cola Co., PepsiCo, and Nestlé, have launched canned water. Ambev will start using its breweries in the southeastern state of Rio de Janeiro to produce its water brand AMA in aluminum cans to be distributed countrywide. The canned products are likely to be sold at a lower price, despite higher costs of production than plastic bottles. More than 97 percent of aluminum beverage cans in Brazil are recycled.[Image Credit: © Ambev]

Brazil’s Ambev SA is expected to launch its first canned water by the end of 2019 in a nod to global trend of increased recyclability and reduction in the use of plastic containers. as consumers shift toward greener alternatives, a company executive said. Parent company Anheuser Busch InBev has begun adopting more sustainable practices. Other multinationals, such as Coca-Cola Co., PepsiCo, and Nestlé, have launched canned water. Ambev will start using its breweries in the southeastern state of Rio de Janeiro to produce its water brand AMA in aluminum cans to be distributed countrywide. The canned products are likely to be sold at a lower price, despite higher costs of production than plastic bottles. More than 97 percent of aluminum beverage cans in Brazil are recycled.[Image Credit: © Ambev]

Chlorophyll Water Claims New Bottles Are Fully Biodegradable In Landfills

Chlorophyll Water, maker of a purified zero-calorie and sugar-free water enhanced with plant-pigment chlorophyll, says its new 20-ounce bottles are now landfill biodegradable, thanks to a bottle mold technology that integrates an organic additive that accelerates decomposition in landfills and anaerobic digesters. The idea of the new technology is to eliminate pollution, reduce greenhouse gas emissions, and recover clean renewable energy. The organic additive is designed to attract microbial activity within the landfill: as microorganisms consume the additive material, they excrete enzymes that break down the bottle. The process results in a bottle that is 100 percent recyclable, BPA-free, non-toxic and now, landfill biodegradable in about seven years. Chlorophyll Water still recommends that its bottles be recycled; each case purchased online comes with a recycling bag.[Image Credit: © Chlorophyll Water]

Chlorophyll Water, maker of a purified zero-calorie and sugar-free water enhanced with plant-pigment chlorophyll, says its new 20-ounce bottles are now landfill biodegradable, thanks to a bottle mold technology that integrates an organic additive that accelerates decomposition in landfills and anaerobic digesters. The idea of the new technology is to eliminate pollution, reduce greenhouse gas emissions, and recover clean renewable energy. The organic additive is designed to attract microbial activity within the landfill: as microorganisms consume the additive material, they excrete enzymes that break down the bottle. The process results in a bottle that is 100 percent recyclable, BPA-free, non-toxic and now, landfill biodegradable in about seven years. Chlorophyll Water still recommends that its bottles be recycled; each case purchased online comes with a recycling bag.[Image Credit: © Chlorophyll Water]

PACKAGING REDESIGNS

Carlsberg Is Working On Prototypes Of Wood Fiber Bottles

Danish brewer Carlsberg says it is developing paper beer bottles made with sustainable wood fibers and a coated interior that prevents seepage. The company is testing two prototypes for its Green Fiber Bottle: one with a thin layer of a recyclable polyethylene terephthalate (PET) plastic in the interior, and the other using instead a polyethylene furanoate (PEF) polymer film that is 100-percent made from natural, biodegradable sources. Carlsberg hopes to create a bottle made from 100-percent organic materials without polymers as part of a plan to achieve zero carbon emissions at its breweries by 2030. Paper is preferable to aluminum or glass, the company says, because it’s sustainably sourced and has a “very low impact on production process.”[Image Credit: © PR Newswire Association LLC]

Danish brewer Carlsberg says it is developing paper beer bottles made with sustainable wood fibers and a coated interior that prevents seepage. The company is testing two prototypes for its Green Fiber Bottle: one with a thin layer of a recyclable polyethylene terephthalate (PET) plastic in the interior, and the other using instead a polyethylene furanoate (PEF) polymer film that is 100-percent made from natural, biodegradable sources. Carlsberg hopes to create a bottle made from 100-percent organic materials without polymers as part of a plan to achieve zero carbon emissions at its breweries by 2030. Paper is preferable to aluminum or glass, the company says, because it’s sustainably sourced and has a “very low impact on production process.”[Image Credit: © PR Newswire Association LLC]