CORPORATE ACTION

Loop: Another Look As It Announces More Expansion

About a year ago a series of the world’s top CPG brands announced their involvement with Loop, a 21st Century version of the milkman model where packaging gets reused. Each brand has its own specially designed packaging, and Loop manages the distribution (via UPS), collection of empties, cleaning and refilling. Spring pilots in New York and Paris tested the concept and had a mixed review.

About a year ago a series of the world’s top CPG brands announced their involvement with Loop, a 21st Century version of the milkman model where packaging gets reused. Each brand has its own specially designed packaging, and Loop manages the distribution (via UPS), collection of empties, cleaning and refilling. Spring pilots in New York and Paris tested the concept and had a mixed review. Too costly, Limited choice

Consumers love the idea of eliminating single-use plastic from their products but as we pointed out in our July 2019 review, they didn’t like the high cost or lack of choice.

When we looked, each product carried a deposit that ranged from $1 to $15.75. We noticed that unit prices on Loop were substantially higher. In our review, we saw Hidden Valley Original Ranch Topping and Dressing on Loop at $3.89 (plus $1.00 deposit) for an 11.7 fl. oz. bottle (33c per fl. oz.), when Walmart.com had a 24 fl. oz. bottle of pretty much the same thing for $3.88 (17c per fl. oz.), about half the unit rate.

On top of all this, shipping costs were up to $20.

Szaky acknowledges how costs are unreasonable currently, but says at scale consumers will not pay more.

Important insight: Benefit of better packaging

Consumers have been very positive about the packaging and this is an important lesson for the brands. Package design took considerable effort – 15 iterations for Nestle – with attention paid to many details.

The Häagen-Dazs packaging is pleasing to look at: a stainless steel canister that is solid to hold with a double metal lining to keep ice cream cold but not freeze the hand. Rounded corners mean ice cream doesn’t get stuck at the bottom.

“People actually are attracted to Loop first for design, second for reuse,” says Tom Szaky, Loop CEO. Packaging for reuse options will be significantly more costly than current versions, so the finding that consumers appreciate superior packaging gives brands headroom to invest in it.

Sara Wingstrand of the Ellen MacArthur Foundation, says that despite using heavier packages, more transportation, and cleaning, it has a lower carbon footprint than single-use packaging.

Loop continues to grow. It’s adding products and later this year will open in California, the UK, Canada, Japan and Germany, with Australia planned for next year.

Evolving business model

And in a significant iteration of its business model, it will soon make products available in retail stores where consumers can buy the product in a Loop section. Retailers will also be locations where consumers can return empty containers. In the US Loop is working with Walgreens and Kroger, Carrefour in France, Tesco in the UK, and Loblow’s in Canada.

A Few Questions

We at Business360 love the concept behind Loop but have a few questions. Aside from our disappointment with missteps in the pilots, we’ve pointed out the checkered past of TerraCycle, the company behind Loop. Through some research we came to the conclusion that these large pioneering brands have options in Loop that can exercise to have an ownership stake.

But the potential remains strong, and in the intervening year the case for reuse has got much stronger since it’s increasingly clear that neither recycling nor composability offer the realistic potential for a circular economy, at least not in the next few years. But Loop and other reuse-refill models do.

We’re wary that Loop is rolling out in so many new markets before truly proving the proposition. And we’re concerned about Loop’s focus on proprietary brands. For those brands participating it may be great, but it’s a walled-garden, a gated community, and therein lies a weakness.

Loop may have lit the blue touch paper but may well end up destroyed by what it started. Still, as a means to jump start a new consumer model and change consumer behavior, it’s all to the good. [Image Credit: © TerraCycle]

PLASTIC INTENSITY: THE DISPIRITING CASE OF COLGATE

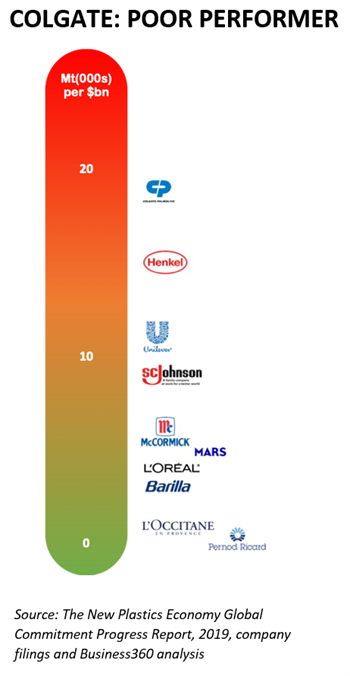

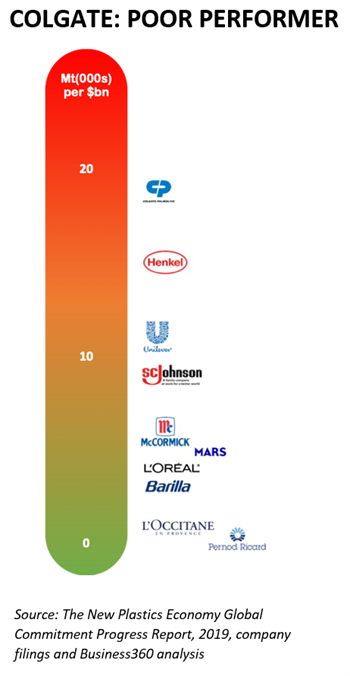

We wanted to have a clear way of seeing how reliant CPGs are on plastic and how well they are doing at lowering their dependency, so we developed a plastic intensity index. It’s not rocket science, but it does give a powerful and accurate way of seeing how much plastic a company uses for each unit of sales.

Soft drinks companies – Coca-Cola, PepsiCo, Danone and Nestle – perform especially poorly given their dependence on plastic bottles. Plastic bottles are already in the public eye and we wanted to dig a little deeper.

According to our plastic intensity index, and excluding beverage manufacturers, Colgate ranks amongst the worst of the large CPG companies. This means it uses more plastic per unit of sales than others. How so?

It turns out that a relatively large amount of plastic is used in each toothpaste tube. Consumers get through 20 billion packs of toothpaste every year, which is a lot of plastic. Of course, Colgate isn’t the only supplier but it’s the leader in many markets.

Moreover, almost all of it can’t be recycled. It’s solidly single-use plastic, destined for landfill, incineration or the ocean. We dug a little deeper into Colgate’s plastic use and what emerges is a dispiriting story that talks to the failure of corporates to listen and lead. (Full disclosure – for about a decade Colgate was a client of our research and competitive intelligence services.)

Blinkers and indifference

Colgate-Palmolive is a venerable company. Over 200 years old and dominant in toothpaste. It was once the disruptive innovator, being the first to sell toothpaste in a collapsible tube (1896 in New York City). Previously it had been sold in glass jars.

Toothpaste today is much the same, predominantly sold in a collapsible tube that is used once then thrown away. But for at least two decades it’s been clear this model wasn’t sustainable. With the small pack sizes the proportion of the product that was single-use plastic was high and at some point it would be unacceptable.

For decades, it was very clear to Colgate that consumers were getting more concerned about sustainability (we can say this with certainty since we covered it numerous times for them). It was a concern for management too and various initiatives came and went. But innovation around a core environmental concern – single-use plastic – has been very slow.

Soon after 9/11 in 2001, liquid restrictions were imposed for plane travel, creating a ready market for pellet/powdered toothpaste. Colgate’s solution was to reduce the pack size to comply with TSA’s rules, squeezing 25ml into a pack that weighs about 45g, essentially more than doubling the proportion of plastic by weight.

2020: Hiding behind ‘recyclable’

Finally, in 2019, the company announced that this year, 2020, it will at last launch a recyclable toothpaste container. This isn’t for all brands, just its Tom's of Maine brand, which earnestly claims that “Caring for the environment has been something we have focused on since 1970”.

Colgate’s other brands, by far the bulk of its sales, must wait until 2025 before they get recyclable packaging.

Of course, even when we reach this milestone most of the collected plastic will not be recycled. Technically, these discarded toothpaste tubes could be recycled but there will not be sufficient processing capacity and by far the majority will end up in landfill, burnt or in the oceans. Colgate knows this but hoodwinks with the misleading term, ‘recyclable’.

Colgate is nonetheless proud of its achievement: “Building a future to smile about means finding new packaging solutions that are better for the planet, but until now there hasn’t been a way to make toothpaste tubes part of the recycling stream,” said Justin Skala, Chief Growth & Strategy Officer for Colgate-Palmolive, in a statement.

Slow to acknowledge plastics

The issue of plastics hasn’t featured strongly in Colgate’s public statements, such as its Annual Reports and annual Colgate Sustainability Reports, despite its reliance on plastic packaging. Only in 2017 was there a marked uptick in mentions of plastic in its sustainability report, just as the world started to mobilize against the issue, but its Annual Report of that year didn’t mention plastic.

Yet Colgate knew it mattered. A decade ago, it heralded its Natura Verde brand’s recyclable bottles, made from 60% recycled plastic, in the 2010 Annual Report.

Missing opportunities, getting vulnerable

This is frustrating for two reasons. First is the apparent indifference it shows. Colgate ($16 billion in sales) has the resources to do much more, but for decades decided to do little to nothing. Clearly, making toothpaste tubes recyclable is a challenge, but ultimately it’s a matter of priority: if Colgate really wanted to develop a recyclable tube it could have done so years back.

Moreover, ‘recyclable’ is not a full solution. Colgate will still remain competitively vulnerable. Which brings us to the second point: for as long as the company rests on an unsustainable business model it remains exposed to more imaginative innovators. And they’re coming.

Here’s a couple. Bite, which is launching this year, plays up its environmental creds – “The only plastic-free and all natural way to replace the paste you've used your whole life. It's time to #KickTheTube.”

Here’s a couple. Bite, which is launching this year, plays up its environmental creds – “The only plastic-free and all natural way to replace the paste you've used your whole life. It's time to #KickTheTube.”

Forbes says Bite is “on a mission to become the world’s most sustainable oral care company by completely revolutionizing the industry.”

Without the backing of $16 billion in sales, founder Lindsay McCormick had to teach herself chemistry from online courses, making the first Bite tablets at home.

Bite runs a subscription model, dispatching its ‘toothpaste bits’ in glass jars. It’s not cheap – ~$7.5/month – but it’s early days and with scale the price should fall dramatically.

Lush, in the UK, launched its dry toothpaste tablets in 2011. It too was concerned about toothpaste tubes. Nearly ten years ago, the inventor of Lush’s Toothy Tabs said they could save “…billions of tubes and boxes from going to landfill.”

These different and more environmentally ways to deliver its product are not news to Colgate. It even sells its own toothpowder in India. Including the typo on its site, it reads “ColgateColgate® Toothpowder is the only tooth powder in India with the amazing power of 2 ingredients – calcium and minerals for stronger, healthier teeth.”

Failure of leadership

For at least two decades Colgate had a clear opportunity to lead. It owned the toothpaste category and rather than acknowledge deep trends and innovate to them, it sat on its hands and tinkered with variants. It will likely release its own solid toothpaste, or buy a startup, much as it bought Tom’s of Maine to secure access to the green market. Either way, it’s a sobering lesson on corporate indifference and inability to change despite the obvious need to act.

[Image Credit: © Business360]

Soft drinks companies – Coca-Cola, PepsiCo, Danone and Nestle – perform especially poorly given their dependence on plastic bottles. Plastic bottles are already in the public eye and we wanted to dig a little deeper.

According to our plastic intensity index, and excluding beverage manufacturers, Colgate ranks amongst the worst of the large CPG companies. This means it uses more plastic per unit of sales than others. How so?

It turns out that a relatively large amount of plastic is used in each toothpaste tube. Consumers get through 20 billion packs of toothpaste every year, which is a lot of plastic. Of course, Colgate isn’t the only supplier but it’s the leader in many markets.

Moreover, almost all of it can’t be recycled. It’s solidly single-use plastic, destined for landfill, incineration or the ocean. We dug a little deeper into Colgate’s plastic use and what emerges is a dispiriting story that talks to the failure of corporates to listen and lead. (Full disclosure – for about a decade Colgate was a client of our research and competitive intelligence services.)

Blinkers and indifference

Colgate-Palmolive is a venerable company. Over 200 years old and dominant in toothpaste. It was once the disruptive innovator, being the first to sell toothpaste in a collapsible tube (1896 in New York City). Previously it had been sold in glass jars.

Toothpaste today is much the same, predominantly sold in a collapsible tube that is used once then thrown away. But for at least two decades it’s been clear this model wasn’t sustainable. With the small pack sizes the proportion of the product that was single-use plastic was high and at some point it would be unacceptable.

For decades, it was very clear to Colgate that consumers were getting more concerned about sustainability (we can say this with certainty since we covered it numerous times for them). It was a concern for management too and various initiatives came and went. But innovation around a core environmental concern – single-use plastic – has been very slow.

Soon after 9/11 in 2001, liquid restrictions were imposed for plane travel, creating a ready market for pellet/powdered toothpaste. Colgate’s solution was to reduce the pack size to comply with TSA’s rules, squeezing 25ml into a pack that weighs about 45g, essentially more than doubling the proportion of plastic by weight.

2020: Hiding behind ‘recyclable’

Finally, in 2019, the company announced that this year, 2020, it will at last launch a recyclable toothpaste container. This isn’t for all brands, just its Tom's of Maine brand, which earnestly claims that “Caring for the environment has been something we have focused on since 1970”.

Colgate’s other brands, by far the bulk of its sales, must wait until 2025 before they get recyclable packaging.

Of course, even when we reach this milestone most of the collected plastic will not be recycled. Technically, these discarded toothpaste tubes could be recycled but there will not be sufficient processing capacity and by far the majority will end up in landfill, burnt or in the oceans. Colgate knows this but hoodwinks with the misleading term, ‘recyclable’.

Colgate is nonetheless proud of its achievement: “Building a future to smile about means finding new packaging solutions that are better for the planet, but until now there hasn’t been a way to make toothpaste tubes part of the recycling stream,” said Justin Skala, Chief Growth & Strategy Officer for Colgate-Palmolive, in a statement.

Slow to acknowledge plastics

The issue of plastics hasn’t featured strongly in Colgate’s public statements, such as its Annual Reports and annual Colgate Sustainability Reports, despite its reliance on plastic packaging. Only in 2017 was there a marked uptick in mentions of plastic in its sustainability report, just as the world started to mobilize against the issue, but its Annual Report of that year didn’t mention plastic.

Yet Colgate knew it mattered. A decade ago, it heralded its Natura Verde brand’s recyclable bottles, made from 60% recycled plastic, in the 2010 Annual Report.

Missing opportunities, getting vulnerable

This is frustrating for two reasons. First is the apparent indifference it shows. Colgate ($16 billion in sales) has the resources to do much more, but for decades decided to do little to nothing. Clearly, making toothpaste tubes recyclable is a challenge, but ultimately it’s a matter of priority: if Colgate really wanted to develop a recyclable tube it could have done so years back.

Moreover, ‘recyclable’ is not a full solution. Colgate will still remain competitively vulnerable. Which brings us to the second point: for as long as the company rests on an unsustainable business model it remains exposed to more imaginative innovators. And they’re coming.

Here’s a couple. Bite, which is launching this year, plays up its environmental creds – “The only plastic-free and all natural way to replace the paste you've used your whole life. It's time to #KickTheTube.”

Here’s a couple. Bite, which is launching this year, plays up its environmental creds – “The only plastic-free and all natural way to replace the paste you've used your whole life. It's time to #KickTheTube.”Forbes says Bite is “on a mission to become the world’s most sustainable oral care company by completely revolutionizing the industry.”

Without the backing of $16 billion in sales, founder Lindsay McCormick had to teach herself chemistry from online courses, making the first Bite tablets at home.

Bite runs a subscription model, dispatching its ‘toothpaste bits’ in glass jars. It’s not cheap – ~$7.5/month – but it’s early days and with scale the price should fall dramatically.

Lush, in the UK, launched its dry toothpaste tablets in 2011. It too was concerned about toothpaste tubes. Nearly ten years ago, the inventor of Lush’s Toothy Tabs said they could save “…billions of tubes and boxes from going to landfill.”

These different and more environmentally ways to deliver its product are not news to Colgate. It even sells its own toothpowder in India. Including the typo on its site, it reads “ColgateColgate® Toothpowder is the only tooth powder in India with the amazing power of 2 ingredients – calcium and minerals for stronger, healthier teeth.”

Failure of leadership

For at least two decades Colgate had a clear opportunity to lead. It owned the toothpaste category and rather than acknowledge deep trends and innovate to them, it sat on its hands and tinkered with variants. It will likely release its own solid toothpaste, or buy a startup, much as it bought Tom’s of Maine to secure access to the green market. Either way, it’s a sobering lesson on corporate indifference and inability to change despite the obvious need to act.

CORPORATE ACTION: Coca-Cola

Coca-Cola’s $11M Global Plastics Cleanup Program Is Lambasted By Greenpeace

Coca-Cola Says Its Consumers Still Want Plastic Bottles

Coca-Cola’s sustainability chief, Bea Perez, says the company is working to help alleviate the plastics problem but won’t be eliminating the use of single-use plastic bottles because consumers still want them. Coca-Cola is a significant contributor to plastic waste: it uses almost three million tonnes of plastic each year in its packaging and was highlighted as the most polluting brand by Break Free from Plastic’s global plastic waste audit in 2019. Ms Perez says that although she understands youth activism on plastic waste, the business still needs to sell its products, and alternative packaging solutions, such as aluminium and glass, might be worse for the environment overall.

Coca-Cola’s sustainability chief, Bea Perez, says the company is working to help alleviate the plastics problem but won’t be eliminating the use of single-use plastic bottles because consumers still want them. Coca-Cola is a significant contributor to plastic waste: it uses almost three million tonnes of plastic each year in its packaging and was highlighted as the most polluting brand by Break Free from Plastic’s global plastic waste audit in 2019. Ms Perez says that although she understands youth activism on plastic waste, the business still needs to sell its products, and alternative packaging solutions, such as aluminium and glass, might be worse for the environment overall.[Image Credit: © The Coca-Cola Company]

Coke Partners With Chinese Online Retailer JD.com To Explore Innovative Recycling Methods

Coca-Cola and China’s largest online retailer JD.com have partnered in a search for new plastic recycling technology. The Chinese company will apply its nationwide logistics system in a pilot project to help collect used beverage bottles from households. The collected bottles are being sent to recycling facilities in partnership with Coca-Cola, where they’ll enter the circular value chain. JD.com launched its Green Stream Initiative in 2017 to reduce the environmental impact of logistics activities. Between June 2017 and December 2019, the company cut use of disposable packaging by nearly 30,000 tons, saving a million tons of paper. Coca-Cola unveiled its World Without Waste initiative two years ago to help collect and recycle the equivalent of 100 percent of its packaging globally by 2030. The recycling partnership was announced at the World Economic Forum in Davos, Switzerland.[Image Credit: © JD.com]

Coca-Cola and China’s largest online retailer JD.com have partnered in a search for new plastic recycling technology. The Chinese company will apply its nationwide logistics system in a pilot project to help collect used beverage bottles from households. The collected bottles are being sent to recycling facilities in partnership with Coca-Cola, where they’ll enter the circular value chain. JD.com launched its Green Stream Initiative in 2017 to reduce the environmental impact of logistics activities. Between June 2017 and December 2019, the company cut use of disposable packaging by nearly 30,000 tons, saving a million tons of paper. Coca-Cola unveiled its World Without Waste initiative two years ago to help collect and recycle the equivalent of 100 percent of its packaging globally by 2030. The recycling partnership was announced at the World Economic Forum in Davos, Switzerland.[Image Credit: © JD.com]

Coke Says Being “Plastics Free” Is A Distant Solution Because Customers Like Single-Use Bottles

Coca-Cola head of sustainability Bea Perez says pleasing customers is more important than ending plastics pollution, so the company won't be phasing out its popular single-use plastic bottles anytime soon. According to Perez, despite the company’s reputation as a global plastics polluter, customers like the bottles because they are lightweight and easily reseal. Getting rid of them, Perez said, would hurt sales. "Business won't be in business if we don't accommodate consumers," she said. The company plans to focus on recycling, promising to recycle as many bottles as it uses by 2030, to use 50 percent recycled materials in packaging by that date and to work with nonprofits to better collect its waste. Environmental groups argue that recycling is not the most effective solution to the plastic pollution crisis.[Image Credit: © The Coca-Cola Company]

Coca-Cola head of sustainability Bea Perez says pleasing customers is more important than ending plastics pollution, so the company won't be phasing out its popular single-use plastic bottles anytime soon. According to Perez, despite the company’s reputation as a global plastics polluter, customers like the bottles because they are lightweight and easily reseal. Getting rid of them, Perez said, would hurt sales. "Business won't be in business if we don't accommodate consumers," she said. The company plans to focus on recycling, promising to recycle as many bottles as it uses by 2030, to use 50 percent recycled materials in packaging by that date and to work with nonprofits to better collect its waste. Environmental groups argue that recycling is not the most effective solution to the plastic pollution crisis.[Image Credit: © The Coca-Cola Company]

Coke Sweden Unveils New Plastic1 Bottles With White Labels Touting Recycling

Coca-Cola Sweden is about to debut a new range of plastic bottles made from recycled plastic1 with white labels that more clearly communicate the message “Recycle me again.” The new labels will be introduced across the Coca-Cola, Fanta, Sprite, and Bonaqua brands and are part of a broad sustainability initiative to create a circular economy for its plastic packaging. According to the company, the transition to 100 percent recycled plastic1 in Sweden affects 205 million bottles a year. Coke Sweden is encouraging customers to return the used bottles to be recycled again, “so that no material is ending up as litter or waste.” The company has an effective deposit system in Sweden: 85 percent of all PET bottles are deposited and recycled. The goal is to reach 100 percent recycling by 2025. [Image Credit: © WebWire/The Coca-Cola Company]

Coca-Cola Sweden is about to debut a new range of plastic bottles made from recycled plastic1 with white labels that more clearly communicate the message “Recycle me again.” The new labels will be introduced across the Coca-Cola, Fanta, Sprite, and Bonaqua brands and are part of a broad sustainability initiative to create a circular economy for its plastic packaging. According to the company, the transition to 100 percent recycled plastic1 in Sweden affects 205 million bottles a year. Coke Sweden is encouraging customers to return the used bottles to be recycled again, “so that no material is ending up as litter or waste.” The company has an effective deposit system in Sweden: 85 percent of all PET bottles are deposited and recycled. The goal is to reach 100 percent recycling by 2025. [Image Credit: © WebWire/The Coca-Cola Company]

CORPORATE ACTION: Nestlé

Nestlé’s Henniez Mineral Water Brand Says All Bottles Made With 75 Percent rPET

Nestlé Waters mineral water brand Henniez announced that all of its plastic bottles are now made of 75 percent recycled PET plastic (rPET). The Swiss brand has been using 30 percent recycled PET since 2013 and hopes to eventually reach 100 percent locally recycled PET. Discarded PET bottles will be made into new Henniez recycled plastic bottles multiple times, without tapping into new oil resources. Three weeks ago, Nestlé committed to invest up to $2 billion to drive the shift from virgin plastics to food-grade recycled plastics. It also committed to speed up development of innovative sustainable packaging solutions. The Henniez mineral water brand celebrates its 115th anniversary this year. [Image Credit: © 2020 Nestlé]

Nestlé Waters mineral water brand Henniez announced that all of its plastic bottles are now made of 75 percent recycled PET plastic (rPET). The Swiss brand has been using 30 percent recycled PET since 2013 and hopes to eventually reach 100 percent locally recycled PET. Discarded PET bottles will be made into new Henniez recycled plastic bottles multiple times, without tapping into new oil resources. Three weeks ago, Nestlé committed to invest up to $2 billion to drive the shift from virgin plastics to food-grade recycled plastics. It also committed to speed up development of innovative sustainable packaging solutions. The Henniez mineral water brand celebrates its 115th anniversary this year. [Image Credit: © 2020 Nestlé]

Nestlé To Invest In Creating A Market For Food-Grade Recycled Plastic

Nestlé has announced a CHF 2 billion investment focused on food-grade recycled plastics, helping it to meet its commitment to make 100% of packaging recyclable or reusable by 2025 and to reduce by one third its use of virgin plastics, also by 2025. Much of the investment will be on paying a premium on food-grade recycled plastics, but it will also launch a venture fund to support sustainable packaging startups in areas such as new materials and refill systems. The moves were welcomed by the Ellen MacArthur Foundation.[Image Credit: © Nestlé]

Nestlé has announced a CHF 2 billion investment focused on food-grade recycled plastics, helping it to meet its commitment to make 100% of packaging recyclable or reusable by 2025 and to reduce by one third its use of virgin plastics, also by 2025. Much of the investment will be on paying a premium on food-grade recycled plastics, but it will also launch a venture fund to support sustainable packaging startups in areas such as new materials and refill systems. The moves were welcomed by the Ellen MacArthur Foundation.[Image Credit: © Nestlé]

CORPORATE ACTION: Other

Italian Beverage Companies Showcase Clean-Label Drinks With Sustainable Packaging

Several Italian beverage companies, represented by The Italian Way - Food & Beverage Excellence (TIW), showcased products with “simple high-quality ingredients” and sustainable, eco-friendly packaging at the Winter Fancy Food Show in San Francisco last month. TIW exhibited three beverage brands: The Bridge (plant-based milks), Smeraldina (artesian water from the island of Sardinia), and Caffè Gioia (100 percent Arabica organic coffees). TIW is targeting the U.S. market because in 2018 the organic food market segment reached $48 billion, with a CAGR of 5.9 percent during 2017. TIW said 83 percent of U.S. consumers believe non-plastic packaging is more environmentally friendly, and 31 percent said they are “very concerned” about the environmental impact of plastic packaging.[Image Credit: © The Italian Way]

Several Italian beverage companies, represented by The Italian Way - Food & Beverage Excellence (TIW), showcased products with “simple high-quality ingredients” and sustainable, eco-friendly packaging at the Winter Fancy Food Show in San Francisco last month. TIW exhibited three beverage brands: The Bridge (plant-based milks), Smeraldina (artesian water from the island of Sardinia), and Caffè Gioia (100 percent Arabica organic coffees). TIW is targeting the U.S. market because in 2018 the organic food market segment reached $48 billion, with a CAGR of 5.9 percent during 2017. TIW said 83 percent of U.S. consumers believe non-plastic packaging is more environmentally friendly, and 31 percent said they are “very concerned” about the environmental impact of plastic packaging.[Image Credit: © The Italian Way]

UK Supermarkets Roll Out New Initiatives To Combat Plastic Waste

A quick look around the UK supermarkets finds continuing work to address plastic waste:

- Tesco is going to swap plastic-wrapped tinned food multipacks with plastic-free multibuy options, removing 67 million pieces of plastic, across Tesco own brands as well as some branded products, including Heinz items.

- Asda has been discussing how to tackle plastic waste with its suppliers, and has called for ideas it can trial at its stores. The chain has also teamed up with Unilever and Kellogg’s in a new pilot store in Leeds, in which customers can refill their own containers.

- Aldi is scrapping own-brand plastic tampon applicators, replacing them with an eco-friendly alternative, following Sainsbury’s lead.

- Marks & Spencer is introducing an aisle in which shoppers can refill their own containers with own-label products like rice, pasta, nuts, cereals, lentils and chocolates. The products will be priced at 10 percent below packaged options. Customers can also choose to buy reusable plastic containers for £7.50 or use a free paper bag.

- Iceland is giving customers the opportunity to buy 38 fresh fruit and vegetable lines in new packaging solutions that are either plastic-free or have a significantly reduced plastic content. The trial runs in 33 stores and is expected to reduce its plastic packaging by 93% across impacted produce

CAMPAIGNS, COMMITMENTS & NGOs

Confusion And Wariness About Some Compostable Plastics

.png&width=125&height=66) The idea of biodegradable plastic that can be composted sounds alluring, but the reality is less encouraging. Many compostable plastics require specialized industrial processes to decompose, many that decompose without specialized treatment may take hundreds or thousands of years to do so, and many compostable plastics can contaminate conventional plastics recycling streams.

The idea of biodegradable plastic that can be composted sounds alluring, but the reality is less encouraging. Many compostable plastics require specialized industrial processes to decompose, many that decompose without specialized treatment may take hundreds or thousands of years to do so, and many compostable plastics can contaminate conventional plastics recycling streams. In the UK, Wrap issued advice on compostable plastic packaging to help retailers and manufacturers make the right decisions when considering using compostable plastic. Wrap says:

- Compostable plastics could be particularly useful for flexible packaging containing food residue

- Rigid compostable plastic packaging, e.g. cups, are generally only beneficial in a ‘closed’ system such as at events or festivals

- Compostable plastics should be avoided where there is potential for them to contaminate conventional plastics recycling

- Clear labelling for citizens on their disposal is crucial

The Ellen MacArthur Foundation Launches Circularity Measurement Tool

INNOVATION & TECHNOLOGY

Glass Benefiting From Eco Advantages

Glass, long seen as the packaging of choice for upscale skincare, make-up and fragrance, is extending to other segments. A shift to glass can help premiumize a product with consumers expressing a preference for its cold solidity and its clear transparency.

Glass, long seen as the packaging of choice for upscale skincare, make-up and fragrance, is extending to other segments. A shift to glass can help premiumize a product with consumers expressing a preference for its cold solidity and its clear transparency. Glass is also benefiting from new techniques that allow for more disruptive and innovative designs, often with reduced mass. One example is the 100ml bottle for Illuminare by Vince Camuto (Parlux Group) that was manufactured by Verescence using its patented SCULPT’in technology

Significantly, most glass is made from natural and sustainable resources, including sand, limestone and soda ash, and is typically 100% recyclable. It’s also easy to recover and some 80% of recovered glass is made into new products. One innovation that is enhancing its appeal is ‘lightened’ glass, which significantly decreases the weight and volume of a package at the same time lowering material use and its carbon footprint.

[Image Credit: © Vince Camuto]

Biodegradable Plastic From BioBeauty Targets Cosmetics Market

Heriot-Watt University of the BioBeauty consortium announced an enhanced polylactic acid (PLA) plastic that is compostable and biodegragable. The PLA, which can be made from plants such as corn starch or sugar cane, includes nano clays to improve the plastic’s barrier properties and rosemary extract that acts as an antioxidant to protect the contained product from degradation. Dr. Helinor Johnston of the university said the product had passed toxicity tests to ensure the plastic is safe for cosmetic use.

BioBeauty. which has been working on this project for about five years, believes the plastic has large potential, especially with natural and organic cosmetics companies that seek packaging options that are not oil-based or non-biodegradable. Johnston said organic beauty is expected to have a global value around $55 billion in ten years and that a survey indicated over 70% of European consumers would be willing to pay more for greener packaging.

In addition to Scotland-based Heriot-Watt, the BioBeauty consortium has seven other partners across Europe: ITENE, Miniland, Alissi Brontë, Alan Coar, Vitiva, Martin Snijder Holding BV and ETS Bugnon.

BioBeauty. which has been working on this project for about five years, believes the plastic has large potential, especially with natural and organic cosmetics companies that seek packaging options that are not oil-based or non-biodegradable. Johnston said organic beauty is expected to have a global value around $55 billion in ten years and that a survey indicated over 70% of European consumers would be willing to pay more for greener packaging.

In addition to Scotland-based Heriot-Watt, the BioBeauty consortium has seven other partners across Europe: ITENE, Miniland, Alissi Brontë, Alan Coar, Vitiva, Martin Snijder Holding BV and ETS Bugnon.

RESEARCH

Jefferies Sees Strict Regulation And Plastic Bans As Concern Rises

The bank points to a wide range of regulations and limitations on plastic use already in place that it believes are just the start of upcoming changes.

But even with these restrictions, Jefferies estimates that the world will struggle to recycle 50% of plastic waste in 10 years. This is because of the current very low rates of recycling and insufficient investment in infrastructure and collections. [Image Credit: © Jefferies]

McKinsey Sees Need For Companies To Make Concerted Effort To Address Plastics Crisis

Beyond low hanging fruit – lightweighting/downgauging packaging – McKinsey argues for “game-changing” solutions that redesign packaging from the ground up with brands and plastic processors working closely together. The consulting company also sees the need for system-wide changes that will require an integrated approach with “concerting effort around improving coordination across the value chain”.[Image Credit: © McKinsey]

Copyright 2026 Business360, Inc.